Motor Vehicle Excise Taxes, Abatements & Exemptions

Motor Vehicle Excise Taxes, Abatements & Exemptions

- How is excise determined?

- When is excise determined?

- Do I qualify for an abatement?

- Excise exemptions

- FAQ

- Contact us

Massachusetts law requires that you pay a tax on registered motor vehicles and trailers. Including motorcycles, cars, buses, off-road vehicles, and trucks. In some cases, you may be eligible for a reduction or refund of your bill.

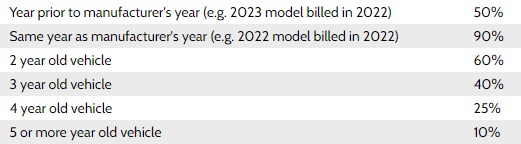

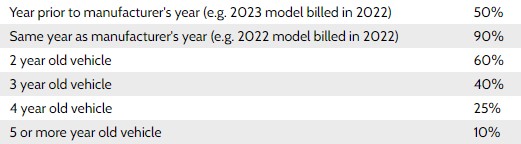

The excise taxed is a percentage of the Manufacturer's Suggested Retail Price (MSRP) based on the age of your car. The RMV sets a table of standard MSRPs based on your car's make and model. Please note that the MSRP is not the price you paid for your car, but rather is a value determined by the RMV.

The percentage of the MSRP is multiplied by the tax rate of $25 per $1000 of value as determined by the RMV. Partial-year bills are calculated according to the number of months of the year during which the vehicle is registered, based on calendar year. For example, excise tax for a vehicle registered in March would be prorated for ten months (March through December.) The full formula for calculating excise tax is below:

MSRP x Percentage x Tax Rate x Number of Months of the Year (beginning with first month of registration through December)

A 2010 Nissan Rogue registered in March and valued at $21,000 would be calculated as follows:

$21,000 x 0.10 x 0.025 x 10/12 = $43.75

Excise is charged through the end of the calendar year and begins on January 1 or the month during which the vehicle is registered. The bill is pro-rated by month, meaning if you have your vehice registered for even one day in a given month, taxation is for the entire month. For example, if a vehicle is registered on March 15th, ten months of excise would be owed, for March through December. Vehicles that are registered as of January 1 are taxed for twelve months.

Do I qualify for an abatement?

If ownership of the vehicle is transferred and the plates are cancelled or transferred to a new vehicle, the excise tax bill may qualify for abatement. In order to receive an abatement, an abatement application must be filed, along with appropriate supporting documents. No abatement will be granted without proper documentation.

Please send documents above, along with a completed abatement application, to the Assessor's office through mail, town drop box, or email.

Who May Qualify?

- A veteran who qualifies for veteran's Disabled Veteran (DV) plates (use of DV plates is not required). Please contact the Veteran's agent at (774) 293-2208.

- A civilian who has lost the use of both eyes, both arms, or both legs

- Legally blind persons

- Service members who are currently or about to be deployed overseas

Filing

There is no required date for motor vehicle exemptions -- you may file at any time. In some cases, we can abate previous years' bills if the qualifications were met at those times. Please contact our office anytime for more information.

For information, please visit myRMV.

I moved from Northborough to another town in MA but received an excise bill from Northborough. What do I do?

Excise bills are based on the garaging code for your vehicle, which is separate from your mailing address with the RMV. If you used to live in Northborough, your garaging code may not have been updated. If you never lived in Northborough, there may have been an error made when inputting the garaging code. To change your garaging code, please visit the myRMV. In the meantime, please pay the bill to the town of Northborough (the excise amount is the same in all MA municipalities). Once the code is changed, you will receive the next excise bill from your new town.

I believe the excise amount on my bill is too high based on my car's value. How do I reduce it?

Car excise is a state tax that is administered through the municipalities. Unfortunately, as the office cannot grant abatements based on improper valuation until receipt of documentation from the RMV confirming an error. If you believe your valuation to be in error, please contact the RMV and begin a value correction process.

The junkyard I sent my car to did not give me a receipt / My car was repossessed without documentation. How do I get an abatement?

It is the responsibilty of the vehicle owner to provide the town with proper documenation of vehicle loss. Until these documents are provided, we cannot grant abatements.

I removed or added my spouse to the vehicle's registration and received a second excise bill. Do I have to pay it?

When the owners on a registration are altered, the RMV sees this as a change in registration and creates a new bill in its next bill run. Bills issued for the same vehicle and/or plate number may be eligible for abatement. Please call the Assessor's office for more information.

I want to pay the excise bill, but cannot do so online. What is the fastest way to pay?

All payments are handled by the office of the Treasurer/Collector. Please contact the Treasurer/Collector's office with questions at 508-393-5045.

QUESTIONS? Please call 508-393-5006

PLEASE RETURN APPLICATION WITH REQUIRED DOCUMENTS:

Board of Assessors, 63 Main Street, Northborough, MA 01532

email: pmespelli@town.northborough.ma.us or bfernandes@town.northborough.ma.us

| Attachment | Size |

|---|---|

| 42.29 KB | |

| 81.14 KB |